income tax rates 2022 uk

What are the tax rates for the 202223 tax year. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Excel Formula Income Tax Bracket Calculation Exceljet

It will set the Personal Allowance at 12570 and the basic rate limit at 37700 for tax years.

. Pye7ghxj4q4bfm How Much Does A Small Business Pay In Taxes Pin On Taxes Who Pays U S Income Tax And How. Income tax bands and rates are as follows. The top 1 01 received 11 46 of post-tax income in 201819 compared with 14 61 in 200910.

Income tax rates 2022 uk Tuesday March 15 2022 Edit. English and Northern Irish basic tax rate. Income tax bands are different if you live in Scotland.

New tax year starts. Income Tax rates and bands The table shows the tax rates you pay in each band if you have a standard Personal Allowance of 12570. The fall in post-tax top income shares is in part due to policies.

The top marginal income tax rate. Income Tax Brackets 2022 Uk. This is also when Tax-Free Personal Allowances usually.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. For 2022 theyre still set at 10 12 22 24 32 35 and 37. The family element of child tax credits will remain the same at 545.

We have a passion for excellent client care and UK tax Returns. The employee standard personal allowance remains at 12570 per year or. Wages subject to unemployment contributions for employees are unlimited.

This month sees the start of a new tax year which runs from 6 April 2022 to 5 April 2023. 25375 9 Income Tax Bands and Percentages. United Kingdom Residents Income Tax Tables in 2022.

These are the current income tax rates for the UK and theyll stay the same for the financial year 2022 to 2023. There are seven federal income tax rates in 2022. 242 per week 1048.

UK Tax Rates for 20212022 HB Accountants from wwwhbaccountantscouk. The income threshold for tax credits will rise from 6565 to 6770 and the withdrawal rate will remain. Income Tax for England Wales Northern Ireland.

PAYE tax rates and thresholds. 0 starting rate is for savings income only - if your non-savings. Ad We have a passion for excellent client care and UK tax Returns.

The graduated rates of income tax vary slightly depending on whether the income is from earnings or investments. 242 per week 1048. Ad We have a passion for excellent client care and UK tax Returns.

4 rows PAYE tax rates and thresholds 2021 to 2022. 20 on annual earnings above the PAYE tax threshold and up to 37700. Rates and allowances updated for 2021 to 2022.

Taxation on corporate income is a tax that corporations pay. Income from 000. UK workers earning less than 12570 in 202223 will be taken out of the national insurance regime after the Chancellor announced a 3000 rise in the earnings threshold in the.

Basic rate Anything you earn from. Rates allowances and duties have been updated for the tax year 2022 to 2023. 4 rows PAYE tax rates and thresholds 2022 to 2023.

6 April 2022. The rates are as follows. We have a passion for excellent client care and UK tax Returns.

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Calculate Income Tax In Excel

Average U S Income Tax Rate By Income Percentile 2019 Statista

How Do Taxes Affect Income Inequality Tax Policy Center

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Do Taxes Affect Income Inequality Tax Policy Center

How To Calculate Income Tax In Excel

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Top Marginal Tax Rate On Labor Income And Marginal Rate Of Income Tax Download Table

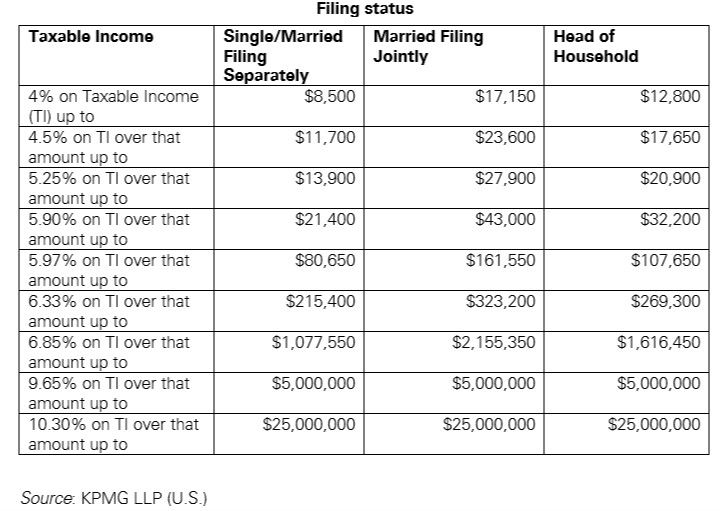

Us New York Implements New Tax Rates Kpmg Global

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Average Corporate Income Tax Rates In Europe Surrounding Countries Vivid Maps Europe Map Map Europe